AlgoTrader is a cutting-edge trading platform designed specifically for algorithmic trading. In this article, we will discuss what AlgoTrader is, who it is suitable for, its benefits and drawbacks, and how to find a broker that offers AlgoTrader and open an account with them.

What is AlgoTrader?

Overview

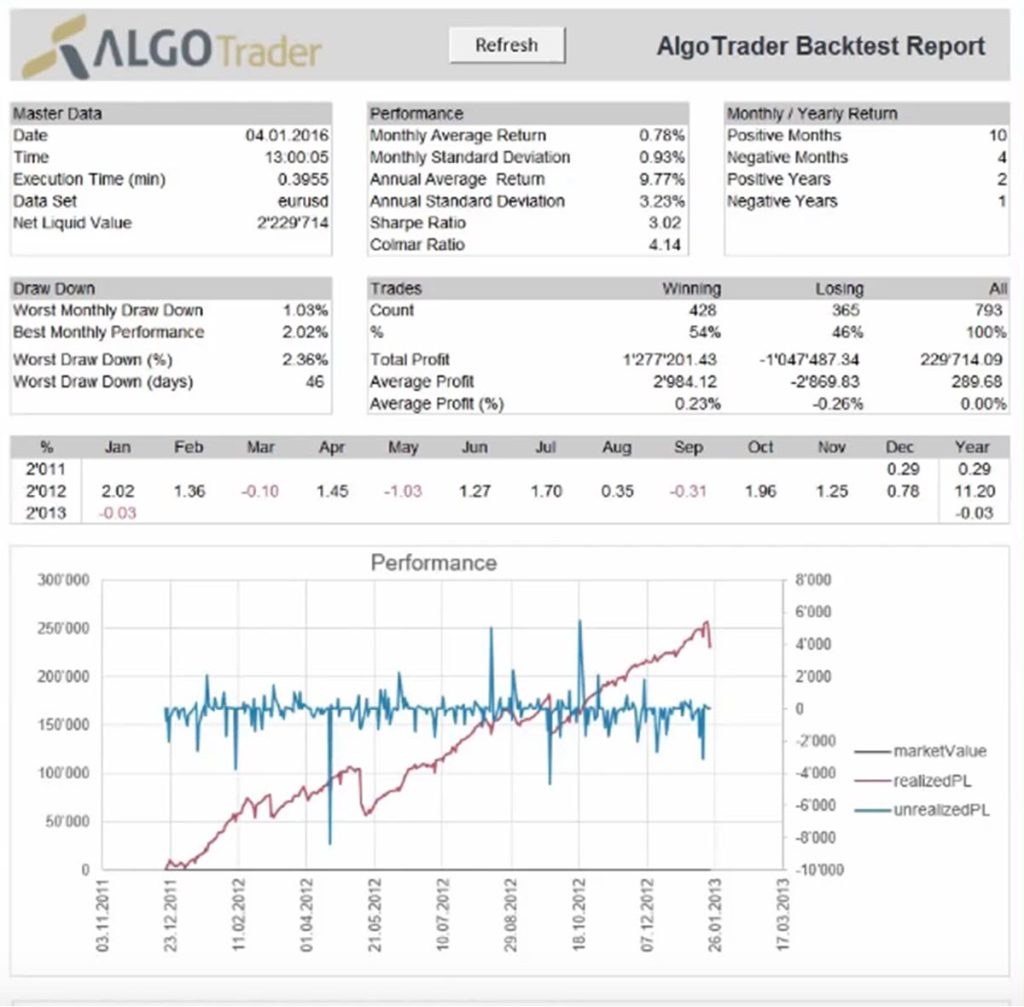

AlgoTrader is an advanced algorithmic trading platform that enables the development, testing, and deployment of automated trading strategies. Founded in 2014, AlgoTrader supports a wide range of asset classes, including equities, futures, options, forex, and cryptocurrencies. The platform is built on a modular architecture and offers a variety of features, such as real-time data processing, historical data management, and advanced backtesting capabilities.

Who is AlgoTrader Suitable For?

Algorithmic Traders

AlgoTrader is designed primarily for algorithmic traders who require a flexible and powerful platform to develop, test, and deploy their automated trading strategies. The platform’s features and capabilities are tailored to support the unique requirements of algorithmic trading, making it an ideal choice for traders who want to optimize their strategies and enhance their trading performance.

Quantitative Analysts and Researchers

AlgoTrader is also suitable for quantitative analysts and researchers who need a robust platform to test their trading models and strategies. The platform’s advanced backtesting and data management capabilities enable users to analyze their strategies’ performance under various market conditions and refine their approach to the market.

Institutional Traders

Institutional traders and hedge funds can benefit from AlgoTrader’s support for multiple asset classes and its ability to manage large volumes of data. Its modular architecture allows for seamless integration with existing trading systems and infrastructure, making it a suitable choice for larger organizations with complex trading operations.

Benefits of AlgoTrader

Advanced Algorithmic Trading Capabilities

AlgoTrader offers a comprehensive suite of tools and features to support the development, testing, and deployment of automated trading strategies. These include real-time data processing, historical data management, advanced backtesting, and a wide range of supported programming languages.

Support for Multiple Asset Classes

AlgoTrader supports a wide range of asset classes, including equities, futures, options, forex, and cryptocurrencies. This enables traders to develop and deploy algorithmic strategies across various markets, providing greater flexibility and diversification in their trading activities.

Modular Architecture

AlgoTrader’s modular architecture allows for seamless integration with existing trading systems and infrastructure. This makes it an ideal solution for organizations looking to enhance their algorithmic trading capabilities without disrupting their current operations.

Customizable and Scalable

AlgoTrader is highly customizable and can be adapted to suit the specific needs and requirements of individual traders and organizations. The platform is built on a scalable architecture that can accommodate the growing needs of traders as their trading activities expand.

Drawbacks of AlgoTrader

Limited Accessibility

AlgoTrader is designed primarily for professional traders, institutions, and hedge funds, making it less accessible to retail traders or those with limited trading experience. The platform’s advanced features and capabilities may be overwhelming for inexperienced users.

Pricing

AlgoTrader’s pricing structure may be prohibitive for smaller traders or those with limited budgets. The platform offers a variety of pricing tiers, including a free trial and several paid subscription options, but the costs can be substantial for smaller-scale operations.

Learning Curve

AlgoTrader’s advanced features and capabilities can present a steep learning curve for new users, particularly those who are inexperienced with algorithmic trading or quantitative analysis. As a result, it may take some time for new users to become fully proficient with the platform.

How to Find a Broker That Offers AlgoTrader

AlgoTrader is primarily designed for use with direct market access (DMA) brokers, which provide traders with the ability to execute their algorithmic trading strategies directly in the market. To use AlgoTrader, you will need to find a broker that supports DMA and offers integration with the platform. Here are some steps for finding an AlgoTrader-compatible broker:

- Research online: Conduct thorough research online to identify DMA brokers that support AlgoTrader. Check broker comparison websites, forums, and AlgoTrader’s official website for a list of compatible brokers.

- Read broker reviews: Look for reviews of DMA brokers that offer AlgoTrader integration to gain insight into the experiences of other traders. This will help you understand the quality of service, trading conditions, and customer support offered by each broker.

- Check for regulation: Ensure that the broker is regulated by a reputable financial authority. This will provide you with a level of protection and assurance that the broker adheres to industry standards and practices.

- Compare fees and commissions: Assess the trading fees, commissions, and other costs associated with each DMA broker that supports AlgoTrader. This will help you determine which broker offers the most competitive pricing structure.

- Evaluate customer support: Evaluate the quality of customer support provided by each broker. This can be done by contacting their support team with any questions or concerns and assessing their responsiveness and professionalism.

How to Open an Account with an AlgoTrader-Compatible Broker

Once you have found a suitable DMA broker that supports AlgoTrader, follow these steps to open an account:

- Visit the broker’s website: Navigate to the website of your chosen broker and locate the account registration or sign-up page.

- Complete the registration form: Fill out the online registration form with your personal details, such as your name, email address, phone number, and country of residence. Some brokers may also require additional information, such as your employment status, financial situation, or trading experience.

- Verify your identity: As part of the account opening process, you will need to verify your identity by providing proof of identification (e.g., a passport or driver’s license) and proof of address (e.g., a utility bill or bank statement). This is a standard procedure for regulated brokers to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

- Select your account type: Choose the type of account you wish to open. This may include options such as standard, professional, or institutional accounts, each with its own set of trading conditions and requirements.

- Deposit funds: After your account has been approved, you will need to deposit funds to begin trading. Most brokers offer a variety of funding methods, including bank transfers, credit/debit cards, and e-wallets.

- Integrate AlgoTrader: Once your account is funded, follow the instructions provided by your broker to connect your trading account to the AlgoTrader platform. This may involve installing the AlgoTrader software, configuring your API access, and setting up your trading environment.

- Begin trading: With your account linked to AlgoTrader, you can now begin developing, testing, and deploying your algorithmic trading strategies. Familiarize yourself with the platform’s tools and resources to optimize your trading performance and develop your skills.

This article was last updated on: April 20, 2023